Providing excellent customer service not only ensures their satisfaction but also helps you build strong, long-lasting relationships. But how do you know if your customer service efforts are paying off? That’s where customer service metrics come into play.

We are going to explore key customer service metrics that you should be measuring, why tracking these metrics is crucial for your business’s growth, how to calculate them, and share some useful tips to help you improve your numbers.

How does measuring customer service metrics benefit your business?

Metrics are valuable for improving customer service efforts and the overall customer experience.

They identify areas of strength and areas needing improvement, leading to increased customer satisfaction. Metrics can also retain customers by identifying those at risk of leaving. By optimizing processes, efficiency improves, and customer experience becomes more seamless.

Moreover, analyzing customer service metrics provides a competitive advantage and identifies training needs for improved performance. Understanding the workload and performance of your customer service team can help you allocate resources effectively and ensure that customer inquiries are handled efficiently.

Table of Contents

- How does measuring customer service metrics benefit your business?

- Customer satisfaction (CSAT) score

- Net promoter score (NPS)

- Customer effort score (CES)

- Internal quality score (IQS)

- Customer engagement

- Customer retention rate (CRR)

- Customer churn rate

- Average customer lifetime value (CLV)

- Reply time

- Resolution time

- Customer feedback response rate

- Average wait time

- Social media insights

- Service channel preferences

- Referral rate

- Conclusion

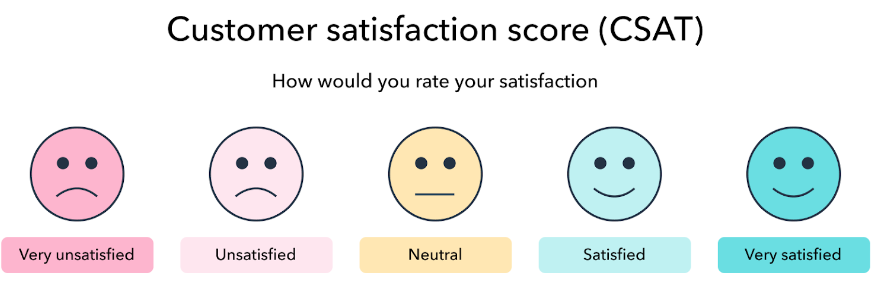

Customer satisfaction (CSAT) score

Customer satisfaction directly impacts customer loyalty, retention, and even acquisition. Customer Satisfaction Score (CSAT) measures how satisfied your customers are with the support they receive or their purchases. Satisfied and happy customers are more likely to stick around, refer others to your business, and become loyal brand advocates.

How do you calculate the customer satisfaction score?

It’s simple – all you have to do is ask your customers a question like, “How satisfied were you with the support you received?” and let them rate their experience on a scale from 1 to 5 or 1 to 10. Then, you can calculate the average score to get your overall CSAT score.

Then, you have to sum up all the positive responses, divide them by the total number of responses, and multiply them by 100 to get the overall percentage of satisfied customers.

For example, let’s say you received 50 total responses and 30 of them were positive.

CSAT (%) = 30 positive responses / 50 total responses x 100

In this case, your CSAT would be 60%.

Tips for improving your CSAT score:

- Make sure your customer support agents take the time to truly understand customers’ needs and concerns. Active listening is important to address their issues effectively and demonstrate that their satisfaction is the main priority.

- Treat your customers individually, not just ticket numbers. Tailor each interaction to their specific needs and preferences, address them by name, and show them they are valued.

- Regularly gather customer feedback through surveys, feedback forms, or social media. Use it to identify areas for improvement and make necessary adjustments to enhance the overall customer experience.

These are just a few tips to kick-start your journey toward improved customer satisfaction. There is much more you can learn and implement to boost your customer experience!

If you are interested in learning more about CSAT and how to calculate it, take a look at our article dedicated to this topic.

Net promoter score (NPS)

NPS measures the likelihood of customers recommending your business to others. Several factors can influence your NPS, such as customer satisfaction, product quality, service reliability, and overall customer experience. By understanding their impact on NPS, you can identify areas where improvements are needed.

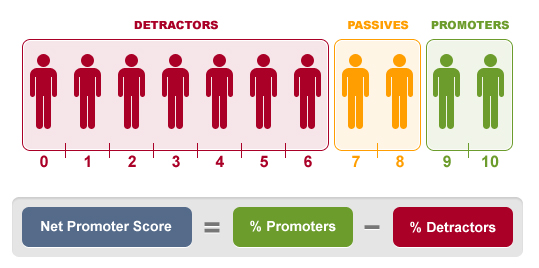

In the case of NPS, customers are categorized into three groups: Promoters, Passives, and Detractors. This depends on how they answer the standard survey question.

- Promoters (scores of 9 and 10) represent the most enthusiastic and loyal customers. They are more likely to act as brand ambassadors, enhance a brand’s reputation, and recommend the company to others.

- Passives (scores of 7 or 8) usually do not actively recommend a brand, but they are also unlikely to damage its reputation with negative reviews. Although they are not included in the calculation of your NPS, they are very close to being promoters. This means you can discover what is holding them back and win them over.

- Detractors (scores of 0 to 6) are unlikely to recommend a brand or its products to others, and in many cases, they will not repeat purchases. They are also the ones that are more likely to leave negative reviews or discourage potential customers from doing business with a brand.

How do you calculate NPS?

Ask your customers a straightforward question: “On a scale of 0-10, how likely are you to recommend our brand?” Based on their response, customers are classified as Promoters (score 9-10), Passives (score 7-8), or Detractors (score 0-6).

The NPS is then calculated by subtracting the percentage of Detractors from the percentage of Promoters.

NPS = % of Promoter – % of Detractors

For example: If 70% of respondents are promoters and 10% are detractors, then your NPS equals 60.

If you’re interested in exploring NPS further, here you’ll discover effective strategies to improve your NPS score, gather valuable feedback, and learn best practices to cultivate customer advocacy.

Customer effort score (CES)

Customer Effort Score (CES) measures the effort a customer has to put in to resolve an issue or complete a task. The aim of CES is to reduce customer effort in order to achieve higher levels of customer satisfaction.

Customers value simplicity and efficiency. When they encounter problems but have to invest excessive effort to resolve them, it can lead to frustration and dissatisfaction. Therefore, businesses should make it as easy as possible for them to interact with the company, resulting in strengthening customer loyalty.

How do you calculate CES?

Measuring this metric involves asking customers a question like, “On a scale of 1-7, how much effort did you have to put in to get your issue resolved?” Customers can rate their effort level from “barely any effort” to “a significant amount of effort.”

The formula is as follows:

CES = Sum of customer effort ratings / Total number of survey responses

Tips for improving your Customer Effort Score:

- Simplify processes, procedures and minimize unnecessary steps to make it easier for customers to interact with your business.

- Provide self-service options such as knowledge bases, FAQs, or tutorials to help customers quickly find valuable information and resolve common queries.

- Offer proactive support by anticipating customer needs and addressing potential issues before they arise – for example, personalized recommendations and check-ins.

- Implement omnichannel support to enable customers to engage with your business across multiple channels. By connecting communication channels such as email, chat, and social media, customers can choose their preferred contact method and receive support efficiently.

Internal quality score (IQS)

Internal Quality Score (IQS) rates customer conversations from your own perspective, unlike CSAT and NPS, which represent customers’ points of view. It assesses how well your team is meeting predefined service standards and delivering exceptional support to customers.

By measuring IQS, you can identify trends, areas for improvement, and training needs within your customer support team. Regularly update the criteria and weights assigned to each KPI to ensure they align with changing customer expectations and business goals.

How do you calculate IQS?

Firstly, you need to establish specific quality criteria that align with your desired service standards. These can include key performance indicators such as response time, resolution time, first contact resolution rate, and customer satisfaction, among others. Each is assigned a weight based on its importance, and then scores are assigned for each interaction or case.

Tips for improving Internal Quality Score (IQS)

- Standardize quality criteria to ensure consistency in assessing internal operations and performance.

- Provide regular training and feedback to your employees to enhance their skills, knowledge, and understanding of quality standards.

- Implement quality management tools and systems to track performance metrics and facilitate quality monitoring and control.

- Encourage collaboration and innovation among team members to drive positive organizational changes.

Customer engagement

Engaged customers are more likely to be loyal, make repeat purchases, and advocate for your brand. Customer engagement is a critical metric beyond measuring satisfaction or transactions and focuses on the customer’s relationship with your business.

Customer engagement can lead to better relationships, increased loyalty and retention, higher customer satisfaction and brand advocacy, up-sell opportunities, and more! Research by OnlineDasher shows that engaged customers contribute 51% more in terms of sales and revenue and tend to spend 60% more per transaction.

How do you calculate the customer engagement score?

Begin with looking at the inputs that reflect customer interaction with your company, such as frequency of usage, specific actions taken, or key performance indicators. Combining all these inputs will allow you to look at one single number instead of multiple data points. For example:

- Loyalty program participation rate: This metric measures the percentage of customers actively participating in your loyalty programs. Loyalty programs encourage customers to engage with your brand and provide a sense of exclusivity. By tracking participation rates, you can measure how well your loyalty programs resonate with customers and encourage their ongoing engagement.

- Customer education and training participation: This allows you to measure the percentage of customers who participate in your business’s educational programs or training sessions. Actively seeking knowledge and engaging in learning opportunities demonstrates their commitment to maximizing the value of your product or service.

Customer retention rate (CRR)

Customer Retention Rate is a metric that measures the percentage of customers who continue to do business with your company over a specific period of time. It directly reflects the effectiveness of your customer retention strategies and the loyalty of your customer base.

Acquiring new customers can be five times more expensive than retaining existing ones. Therefore, Don’t underestimate the importance of customer retention. it is key to the long-term success and profitability of your business.

How do you calculate CRR?

Calculating CRR involves determining the number of customers at the beginning and end of a particular time period and comparing the two. The formula to calculate CRR is:

CRR (%) = [(E – N) / S] x 100

Where:

- E = Number of customers at the end of the period

- N = Number of new customers acquired during the period

- S = Number of customers at the start of the period

For example:

Let’s say a company had 200 customers at the start of the period (S) and ended the period with 200 customers (E). However, they could also add 20 new customers over the time period (N). Then the calculation would go something like this:

[(200-20)/200] x 100 = 90% (CRR)

Look at our article, where we provide strategies and tips to improve customer retention, enhance customer loyalty, and establish long-term relationships with your customers to gain valuable insights!

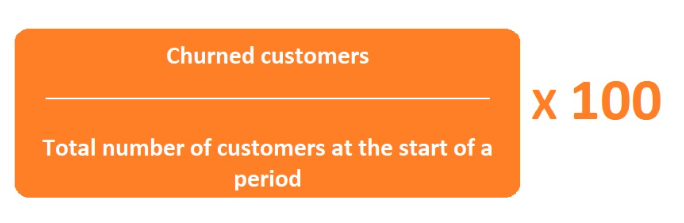

Customer churn rate

In simple terms, the customer churn rate is a metric that quantifies the number of customers who have left a business or stopped using their product or service over a given period.

What causes customer churn?

- Poor customer service

- Lack of communication

- Frequent product or service issues

- The price is not worth the value

- Lack of personalization

- Better competitive offerings

- Changing circumstances or needs

- Negative reviews or a bad reputation

How do you calculate the customer churn rate?

Determine the number of customers lost during a specific period and divide it by the total number of customers at the start of that period.

Churn Rate = (Customers Lost / Starting Customers) x 100

Let’s say a company had 250 customers at the beginning of a month, and they lost 20 customers during that same month. The calculation would go like this:

(20 / 250) x 100 = 8% churn rate

Tips to prevent customer churn:

- Provide excellent customer service and support, and ensure that your customer service team is responsive, knowledgeable, and empathetic.

- Personalize the customer experience to meet your customers’ specific needs and preferences to create a deeper connection and make customers feel more valued.

- Implement loyalty programs or exclusive offers to incentivize customers to stay with your brand.

- Regularly ask for feedback from your customers to understand their pain points, identify areas for improvement, and address concerns before they lead to churn.

Average customer lifetime value (CLV)

Average Customer Lifetime Value estimates the average revenue a customer will generate throughout their entire relationship with your company. Determining CLV helps you make informed decisions about customer acquisition costs, retention strategies, and personalized marketing efforts to maximize long-term profitability.

How do you calculate CLV?

The basic formula for calculating CLV is:

CLV = (Average Purchase Value * Purchase Frequency * Average Customer Lifespan)

For example, if the average purchase value per customer is $50, the average customer makes 5 purchases per year, and the average customer lifespan is 3 years, the CLV would be calculated like this: CLV = ($50 * 5 * 3) = $750

However, there are other ways to calculate CLV. Let’s look at the two most popular models and their formulas:

- Historic CLV

This model requires a basic calculation of adding up gross profit value per customer for all of their transactions.

The formula is also quite simple:

Historic CLV = (Purchase 1 + Purchase 2 + Purchase 3 + …) x Average Gross Margin

The gross margin average is the margin for the average of your store’s orders. Calculate your margins based on as many elements as possible, from boxes and shipping to acquisition costs, returns, and replacements.

- Predictive CLV

The predictive CLV is a more complex equation designed to attempt to provide an accurate CLV value for your company’s past and future customers. It’s a little more complicated:

Predictive CLV = [(Average Monthly Transactions x Average Order Value) x Average Customer Lifespan]

Tips to increase customer lifetime value:

- Provide ongoing customer support throughout their journey, and offer assistance and guidance whenever needed.

- Identify opportunities to upsell or cross-sell additional products or services that enhance the value for customers while meeting their evolving needs.

- Deliver consistent product quality.

Reply time

Reply time is a metric evaluating the speed at which support representatives respond to customer inquiries. It is an important aspect of providing a positive customer experience as it directly impacts customer satisfaction and perceived level of service.

Implementing tools like help desk software can significantly improve your reply times. LiveAgent is an all-in-one solution that offers features like a universal inbox, automatic ticket routing and assignment, canned messages, customizable SLAs, and much more. These features allow you to streamline your workflow, reduce response times, and deliver exceptional customer service.

There are two common types of reply time metrics: First reply time and Average reply time.

First reply time

This customer service metric measures the time it takes to respond to a customer’s initial inquiry. It begins when the customer reaches out for assistance and ends when they receive the first response from a support representative.

How do you calculate FRT?

All you need to do is simply divide the total first reply time for all agents by the total number of resolved tickets in a given time period.

FRT = Total FRT / Number of resolved tickets

To improve your first reply time, consider the following tips:

- Implement automated ticket routing that assigns incoming tickets to the most appropriate support representative based on skills, workload, or other predefined criteria.

- Set clear response time goals and communicate these expectations to your support team. Don’t forget to regularly monitor whether these goals are being met.

- Prioritize urgent inquiries or high-priority inquiries to ensure that critical issues receive immediate attention and resolution.

Average reply time

Average reply time measures the average time it takes for your support team to respond to customer inquiries or tickets. Unlike FRT, which focuses on the initial response, average reply time considers the overall time it takes to provide subsequent replies throughout the customer interaction.

Research shows that an astonishing 82% of customers expect a response within 10 minutes or less, especially regarding sales. Customers value timely responses and consistent communication, and a long reply time can lead to frustration and negatively impact customer satisfaction.

How do you calculate your average reply time?

Add up the time it takes to reply to each customer interaction and divide it by the total number of interactions.

Average Reply Time = Sum of individual reply times / Total number of inquiries

Tips to improve average reply time:

- Simplify and automate repetitive tasks, utilize canned responses for common inquiries, and ensure smooth coordination between team members.

- Utilize automation and AI chatbots to handle simple and frequently asked questions, freeing up your support team’s time to focus on more complex issues.

- Train your support team on efficient communication and problem-solving techniques to minimize response time.

Resolution time

Average resolution time is a KPI that measures the time it takes for a support team to resolve customer inquiries or issues. The specific time frame can vary depending on the complexity of the issue and the nature of the support request.

Most customers expect their problems to be addressed and resolved as quickly as possible. Long resolution times often lead to frustration and a negative perception of your customer service capabilities. On the other hand, quick and efficient resolutions leave customers feeling satisfied, valued, and more likely to remain loyal.

Customer complaint resolution time

This specific metric focuses on the time it takes to resolve customer complaints or escalated issues. It reflects the responsiveness and efficiency of your customer support team in addressing and resolving customer concerns.

How do you calculate the customer complaint resolution time?

Start measuring it from the moment the complaint is lodged or escalated and stop the timer when the complaint is fully resolved to the customer’s satisfaction. For example, if a customer submits their complaint on Monday, and your team manages to resolve it on Wednesday, the resolution time would be two days.

To make improvements in customer complaint resolution time, consider following these simple tips:

- Streamline internal processes, establish clear escalation paths, and provide tools and resources to empower your agents to handle complaints effectively and efficiently.

- Offer multiple channels, such as phone, email, live chat, or social media, for customers to contact with their complaints. Make sure all these channels are actively monitored and that all customer queries are promptly acknowledged.

- Equip your customer service team with the resources to address complaints confidently and competently.

Customer feedback response rate

The feedback response rate measures the percentage of customer feedback that your business acknowledges and responds to. It reflects your engagement level and attentiveness to customer feedback. Responding to customer feedback in a timely manner demonstrates your commitment to customer satisfaction and shows that you value your customers’ input and opinions.

How do you calculate customer feedback response time?

Just divide the number of customer feedback that has received a response from your business by the total number of customer feedback received. Multiply the result by 100 to get the percentage.

Customer feedback response time = Number of feedback that received response / Total number of customer feedback x 100

Here are some tips for improving your feedback response rate:

- Set clear response time goals and communicate these targets internally.

- Prioritize customer feedback based on its urgency or potential impact. Focus on responding promptly to critical or high-priority feedback to demonstrate your dedication to resolving critical issues.

- Personalize your responses and avoid generic or automated responses as they can come across as impersonal. Take the time to address each concern or question individually.

- Respond to feedback with actionable resolutions whenever possible to show you take their concerns seriously and are committed to addressing them.

- Monitor and analyze feedback patterns to identify common and recurring issues.

If you don’t know where to start or feel overwhelmed by responding to customer feedback, don’t worry – we’ve got you covered. We have compiled a list of effective feedback email templates that you can use to provide thoughtful and tailored responses to your customers. Our templates are designed to address different types of customer feedback.

Using these customer feedback response templates can help you save time, ensure consistency in your responses, and provide a professional and customer-centric approach to addressing customer feedback.

Average wait time

From a customer’s perspective, the wait time is a crucial aspect of customer service that directly impacts their experience and satisfaction. As many as 89% of customers say that a quick response to their initial inquiry influences their purchasing behavior. On the other hand, slow response times and long waiting times cause 52% of customers to stop purchasing from a business.

Simply put, average wait time shows how long customers spend in a support queue before receiving assistance from a live agent.

How do you calculate the average wait time?

Calculating average response time involves summing up the individual wait times for all customers and dividing it by the total number of customers served. This calculation provides an average value showing how long customers typically wait before receiving assistance.

AWT = Total wait time / Number of customers served

For example: a company receives 200 support calls during the whole day. The total waiting time was 500 minutes.

With these numbers, the calculation would go something like this:

AWT = 500 minutes (total wait time) / 200 calls (answered) = 2.5 minutes per call

Tips to help you reduce wait times:

- Implement a reliable help desk system, such as LiveAgent, that can efficiently and automatically route tickets to available agents based on workload, expertise, or priority. This ensures that customers are connected with the most appropriate representative promptly, minimizing wait times.

- Offer self-service resources such as a comprehensive knowledge base, customer portal, or FAQs. These resources empower customers to find answers to common queries on their own without the need to contact customer support.

- Evaluate demand patterns and align your customer support staffing levels accordingly. Make sure that there are enough representatives available to handle customer inquiries during peak hours.

- Integrate artificial intelligence and chatbot technology into your customer service strategy to provide instant responses and support 24/7.

Social media insights

70% of customers expect companies to use social media to provide customer service.

However, creating a social media account for your business is only the first step. You must also start tracking your mentions and comments on these platforms to gain valuable insights into customer sentiment and satisfaction. By monitoring social media interactions, you can identify both positive and negative feedback in real time, allowing you to address issues promptly and capitalize on positive experiences.

After collecting the feedback, you need to analyze it and take action. It helps you determine the following:

- How many comments from users provide feedback (negative or positive)?

- How many questions are technical?

- How many questions can be answered through already existing content?

- When are the users most active on social media?

- Are there any emerging trends, preferences, or patterns in customer behavior?

- Are there recurring themes or common issues raised by customers?

- Are there any customer suggestions or requests for product/service improvements?

- Are there any mentions of competitors or comparisons with other brands?

- Are there any opportunities for engagement or community-building based on customer interactions?

Service channel preferences

Understanding the channel preferences of your customers allows you to provide support in a way they find most convenient and comfortable. Service channel preferences refer to the specific communication channels that your customers prefer to use when seeking assistance or support. By catering to their preferences, you can enhance customer satisfaction, increase engagement, and improve the overall customer service experience.

How do you track service channel preferences?

- Customer surveys: When sending a customer satisfaction survey or post-interaction survey, include questions about their preferred communication channels.

- Data analysis: Analyze your customer interactions to identify patterns in channel usage. Look at metrics like ticket volume through different channels, response times, and customer feedback to gain necessary insights.

- Customer feedback and support tickets: Pay attention to feedback and comments in support tickets. Customers may specifically mention their preferred channels or express preferences during their interactions.

- Use website analytics: These analytics show you which channels customers use to initiate contact or seek support.

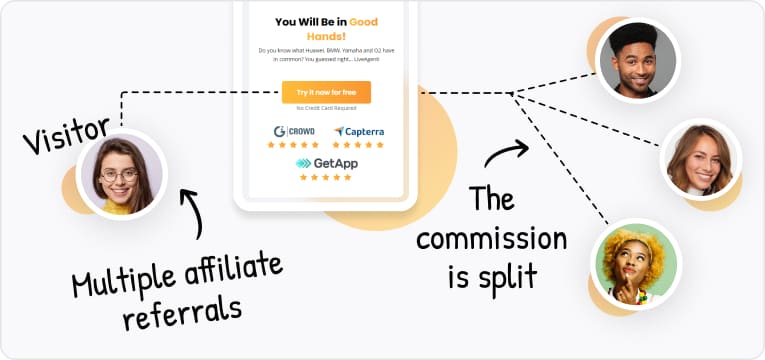

Referral rate

If you want to measure the number of customers who refer your brand, products, or services to others, you can do so by tracking and monitoring your referral rate. This metric indicates how your existing customers actively promote your company to their friends, family, or colleagues.

Understanding the relationship between referral rate and affiliate marketing can be very beneficial when boosting customer acquisition and fostering brand advocacy. However, it is important to note that these strategies are not the same. While a referral rate measures the organic, word-of-mouth recommendations made by satisfied customers, affiliate marketing is a structured program where individuals or businesses are encouraged to refer customers in exchange for rewards.

Affiliate marketing can be seen as a strategic extension of a company’s referral program. Affiliates use their platforms, networks, and promotional skills to drive traffic and conversions while earning commissions for successful referrals. By partnering with affiliates, companies can expand their referral efforts and reach a wider audience.

Referral tracking software

Implementing referral tracking software can help businesses streamline tracking and managing customer referrals. Here are some reasons why considering this software is beneficial:

- Accurate tracking: It provides a reliable and accurate way to track referrals and their origins. It automates the process, ensuring that all referrals are accounted for and properly attributed to the referring customers, eliminating the risk of manual errors, and ensuring fairness in the referral rewards.

- Transparency and accountability: Both the referrers and the referred customers can have visibility into the status of their referrals, such as whether they have converted into customers or if the associated rewards have been granted.

- Efficient management: The software also simplifies referral program management. It allows you to set up and customize referral programs, define commission structures, and track performance and conversion rates. This boosts efficiency by streamlining administrative tasks and reducing manual effort.

- Performance analytics: You can analyze data on referral sources, conversion rates, and key metrics to optimize your strategy, as it provides detailed insights into the effectiveness of your referral program.

Conclusion

In conclusion, effective customer support plays a key role in building customer loyalty, improving satisfaction, and ultimately driving business growth. Businesses can gain valuable insights into their customers’ needs and preferences by tracking key customer service metrics such as customer satisfaction, customer effort score, reply times, and engagement.

Monitoring and analyzing these metrics enable businesses to make data-driven decisions, identify areas for improvement, and implement strategies to enhance the overall customer experience. What’s more, incorporating these metrics into your customer acquisition marketing efforts can drive better results!

LiveAgent offers a comprehensive solution for businesses looking to monitor and improve their customer support metrics. With advanced features for ticket management, live chat, call center integration, and social media monitoring, LiveAgent empowers businesses to deliver top-notch customer service. Take advantage of LiveAgent’s capabilities with their 30-day free trial. Experience the difference that efficient customer support can make in driving customer satisfaction, loyalty, and business success.

Say goodbye to customer service challenges!

Improve efficiency and streamline customer communication with LiveAgent's customer service software. Get started with a free trial today!

Frequently Asked Questions

What do service metrics indicate?

These metrics indicate the performance and effectiveness of customer service operations. They provide insights into various aspects of customer interactions, such as response times, customer satisfaction, engagement levels, and referral rates. By analyzing service metrics, businesses can identify areas for improvement and drive customer satisfaction and loyalty.

What are the most important metrics for a customer support team?

Some of the most important metrics for customer support include customer satisfaction (CSAT), first response time, average ticket resolution time, and customer retention. These metrics help measure the team's ability to meet customer needs and provide timely resolutions.

What are customer-focused metrics?

Customer-focused metrics assess a company's dedication to putting its customers at the center of its operations. These metrics evaluate how well a company understands and meets customer needs, measures customer satisfaction, identifies customer pain points, and tracks customer loyalty. These metrics help businesses ensure their strategies and actions align with customer-centric goals.

What are the indicators of good customer service quality?

Some of these indicators include high customer satisfaction ratings, positive customer feedback and reviews, high retention rates, and strong customer loyalty. In addition, prompt response times, effective issue resolution, and personalized interactions are also signs of excellent customer service quality.

Customer communication management software

LiveAgent customer communication management software will provide personalized, quick, and knowledgeable service to your customers. Try it for free.

Smart customer satisfaction software

Boost customer satisfaction in 2025 with LiveAgent! Deliver personalized, 24/7 support on every channel. Free trial, no credit card needed.

Understanding customer retention: Definition, importance, and strategies

Master customer retention with 13 proven strategies, key metrics, and real examples. Boost loyalty, profits, and brand reputation today!

Български

Български  Čeština

Čeština  Dansk

Dansk  Deutsch

Deutsch  Eesti

Eesti  Español

Español  Français

Français  Ελληνικα

Ελληνικα  Hrvatski

Hrvatski  Italiano

Italiano  Latviešu

Latviešu  Lietuviškai

Lietuviškai  Magyar

Magyar  Nederlands

Nederlands  Norsk bokmål

Norsk bokmål  Polski

Polski  Română

Română  Русский

Русский  Slovenčina

Slovenčina  Slovenščina

Slovenščina  简体中文

简体中文  Tagalog

Tagalog  Tiếng Việt

Tiếng Việt  العربية

العربية  Português

Português