-

![How to make an AI chatbot: A beginner’s handbook]()

How to make an AI chatbot: A beginner’s handbook

Explore our definitive guide for developing powerful AI chatbots from the ground up. Learn which key technologies and practical steps… Learn More

-

May 2025LiveAgent Monthly Update

![LiveAgent monthly updates: May edition]()

LiveAgent monthly updates: May edition

This month, we’ve rolled out the new “Blind Transfer” call function, refined the mass action options in the tickets list,… Learn More

-

![Key benefits of chatbots for your business efficiency and customer retention]()

Key benefits of chatbots for your business efficiency and customer retention

Classic rule-based bots and chatbots have been helping enterprises for more than a decade now, but what about AI chatbots… Learn More

-

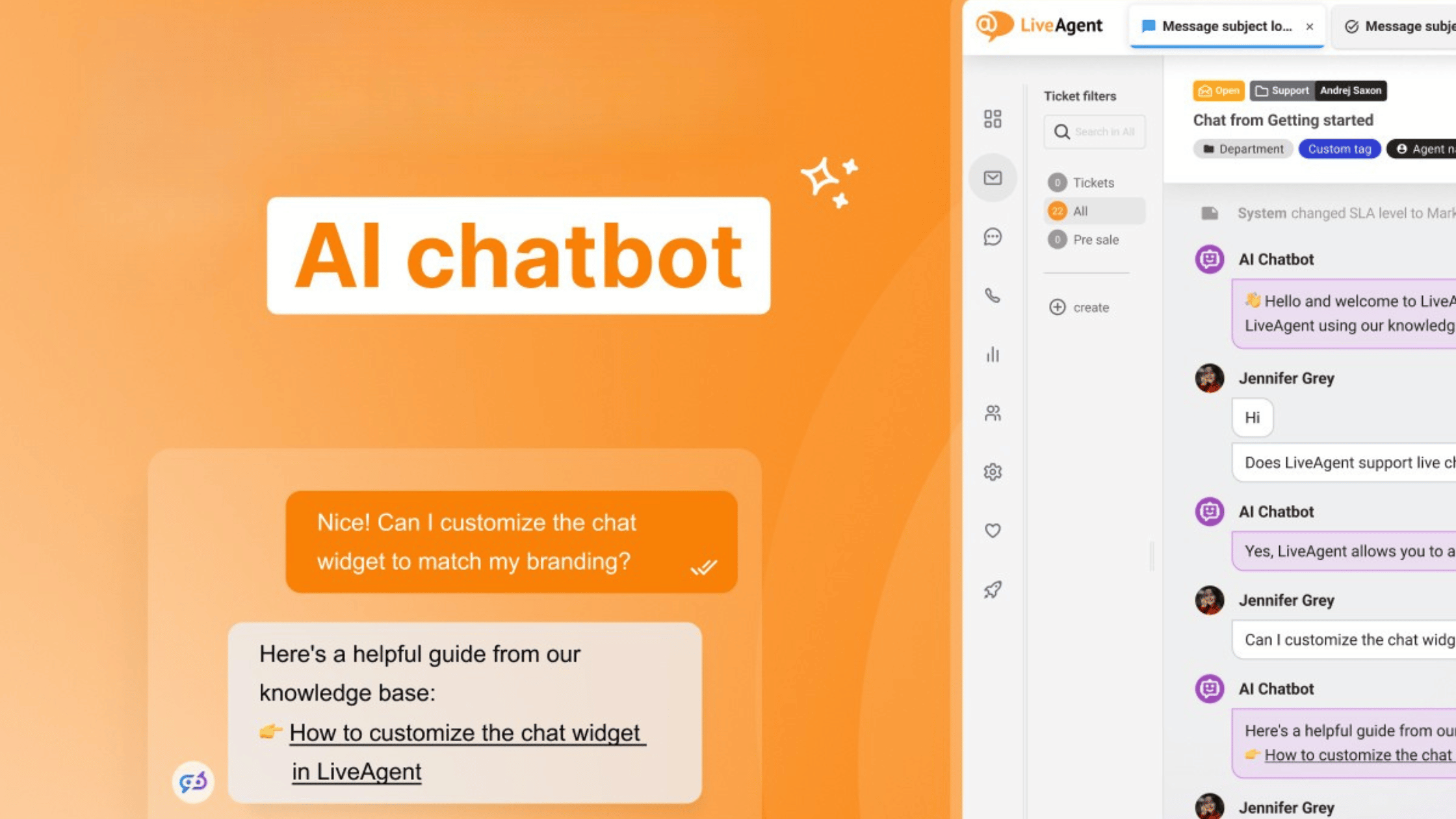

![How LiveAgent resolved 75% of chat interactions via the AI Chatbot]()

How LiveAgent resolved 75% of chat interactions via the AI Chatbot

LiveAgent operates a large SaaS website that attracts significant visitor traffic. While many visitors are interested in our product, a… Learn More

-

![What is the best AI Chatbot in 2025?]()

What is the best AI Chatbot in 2025?

We’ve reviewed the most popular AI chatbots and selected the top 5 best AI chatbots for you in this article.… Learn More

-

April 2025LiveAgent Monthly Update

![LiveAgent monthly updates: April edition]()

LiveAgent monthly updates: April edition

This month, our primary focus has been dedicated towards enhancing system performance and user experience. These enhancements range from minor… Learn More

-

![LiveAgent wins the Leader Award in multiple categories from SourceForge]()

LiveAgent wins the Leader Award in multiple categories from SourceForge

LiveAgent is proud to receive the Spring 2025 Leader Award in key customer service categories such as Help desk, Live… Learn More

-

March 2025LiveAgent Monthly Update

![LiveAgent monthly updates: March edition]()

LiveAgent monthly updates: March edition

March brings the exciting announcement of the launch of the LiveAgent AI Chatbot, delivering on our promise to enhance customer… Learn More

-

February 2025LiveAgent Monthly Update

![LiveAgent monthly updates: February edition]()

LiveAgent monthly updates: February edition

This month, we are excited to share some positive advancements to LiveAgent. We will give you a sneak peek at… Learn More

Our website uses cookies. By continuing we assume your permission to deploy cookies as detailed in our privacy and cookies policy.

Български

Български  Čeština

Čeština  Dansk

Dansk  Deutsch

Deutsch  Eesti

Eesti  Español

Español  Français

Français  Ελληνικα

Ελληνικα  Hrvatski

Hrvatski  Italiano

Italiano  Latviešu

Latviešu  Lietuviškai

Lietuviškai  Magyar

Magyar  Nederlands

Nederlands  Norsk bokmål

Norsk bokmål  Polski

Polski  Română

Română  Русский

Русский  Slovenčina

Slovenčina  Slovenščina

Slovenščina  简体中文

简体中文  Tagalog

Tagalog  Tiếng Việt

Tiếng Việt  العربية

العربية  Português

Português