What is ROI?

Return on investment (ROI) is a popular metric that evaluates an investment’s profitability and efficiency. The metric is integral when comparing the profitability of multiple investments.

A return on investment metric gives the foresight to determine whether an investment will deliver a positive return. It, therefore, lets you make financial decisions that are more likely to be successful.

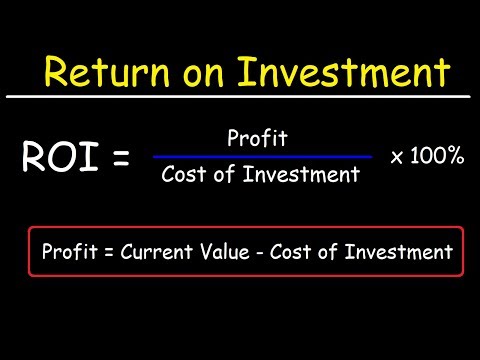

How to calculate ROI?

Basic ROI calculation entails:

- Subtracting the initial investment from the final value of the investment (which is also the net return).

- Dividing the net return by the cost of investment.

- Multiply it by 100 (to express the value as a percentage).

The final investment value – Initial investment value

ROI = ⸻⸻⸻⸻⸻⸻⸻⸻⸻ X 100%

Cost of investment

Net return on investment

= ⸻⸻⸻⸻⸻ X 100%

Cost of investment

The problem with the average ROI formula is that it doesn’t take into account time periods.

For instance, consider a business that sets up an ROI call center solution with LiveAgent’s software and makes a return on investment of 20% in 3 years. The formula suggests that returns after 10 days of the setup and returns after 3 years are the same. In reality, a return of 20% in 10 days is much better than 3 years.

To overcome such a problem, you can use the annualized ROI formula to get an annual return.

The formula for calculating annualized returns is as follows:

Annualized ROI = [(1 + ROI)1/n — 1] X 100

Let’s assume an investment has generated a return on investment ratio of 60% over six years. A beginner investor can assume that the simple average ROI is 10% by dividing returns by the holding period.

But this is only a rough approximation of annual return because it ignores the effect of compounding on investment (which can make a significant difference over time). The longer the period, the bigger the difference.

The annual rate in this case, from the correct formula, is:

Annual ROI = [(1 + 0.60)1/6 — 1] X100 = 8.15%

The best part of the annualized formula?

You can use it for holding periods less than a year by converting the holding period to a fraction of a year.

A positive return on investment means a net profit because the returns exceed the conversion cost and any additional costs that might occur.

A negative ROI shows a loss in the value of the investment during a specific period. It refers to a loss, either on investment, a business performance, or an invested project.

You can use ROI’s formula to:

- Measure the profitability of a stock

- Justify a project

- Assess the performance of real estate transactions

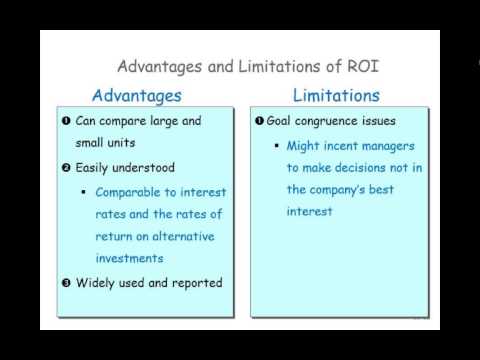

What are the limitations of the ROI formula?

Although a return on investment is easy to calculate, it’s not without limitations:

It ignores time

The return on investment formula ignores the time value of money and is less accurate when evaluating long-term investments. It doesn’t consider the broader time value of money or an investment’s holding period. This means it can be less accurate when assessing long-term investments that require more time to turn a profit.

It doesn’t adjust for risk

Risk and return are always intertwined. The higher an investment’s potential return, the greater the corresponding risk. ROI’s projections don’t evaluate associated investment risks, only the final and initial cost.

It can oversimplify the comparative process

The formula only compares the cost of investment to the final cost. Every firm you compare must follow similar accounting practices to maintain consistency. If you assess a company’s asset value or profit differently, it might make the direct return on investment comparison inaccurate.

To overcome the above limitations, investors consider the annualized return on investment to assess the profitability of an investment.

Calculating returns alone can be a trap. It measures efficiency, which is fine and useful.

If a company cuts its budget in order to reduce investment and maintenance costs, it might end up with false calculations.

While maintaining a low maintenance cost is critical, cutting on marketing campaigns or any other marketing investment might cripple the rate of earnings.

A business might still have positive ROI calculations in such a case, but not realize its full earning rate potential because of focusing on short-term results.

What is a good ROI for a business?

What’s considered a good ROI depends on the type of investment. For instance:

| Type of investment | Example of Good ROI |

|---|---|

| A marketing campaign | Multiplying your investment 5X |

| Social media marketing effort | Growth of followers count or post impressions |

| Investing in customer relationship management | 140% increased expenditure on product |

| Venture capitalism | Extra-high potential returns because only 4/10 startups make a profit |

| Setting up ROI call center solutions | Increased customer retention rate and lifetime value |

Not all investments are equal—look at risk-adjusted returns as the performance measure.

According to conventional wisdom, an annual ROI of over 7% is good for stock investment. This is the average annual return of the S&P 500, accounting for inflation.

However, the S&P ROI figure might be unfit for your asset class or the risk level you’re willing to take. It varies with different investments, so you might want to consider:

- The risk level you want to take

- What will happen if you lose the money you invest

- How much profit do you need from the investment opportunity

Generally, the higher the return, the better. However, it’s difficult to find a business with increased investment returns without higher risk in real life.

Risk is integral in assessing rate or return. A high potential return comes with a bigger risk.

Probing the market and taking advantage of investing research services can keep you well-informed with important factors that need to be considered when making decisions, such as risk assessment, market analyses, and financial recommendations.

Generally, a good ROI is positive—the net returns exceed net costs. A bad ROI is negative—the net cost exceeds the returns.

Invest efficiently

LiveAgent's omnichannel help desk software offers over 130 features that will make sure your investment was right. Want to learn more?

Watch a video about ROI

LiveAgent help desk software helps companies manage customer inquiries and digital conversations. This powerful tool enables companies to automate routine customer tasks, prioritize customer inquiries effectively, and measure return on investment (ROI). Built-in analytics enable companies to gauge customer sentiment, quickly identify growth opportunities, and increase customer satisfaction. LiveAgent HelpDesk software also provides an intuitive user interface for customer service agents in order to maximize product adoption and customer satisfaction. With all these features, LiveAgent HelpDesk software provides companies with an unparalleled return on investment through increased customer satisfaction, higher revenue growth, and better customer service.

Frequently Asked Questions

What is ROI?

Return on investment (ROI) is a simple ratio that divides the net profit (or loss) from an investment by its cost.

How to calculate return on investment?

To calculate return on investment, divide net profit (present value — initial investment) by the cost of investment and multiply that by 100.

What are the limitations of the ROI formula?

The return on investment formula does not take time into account. It thus ignores compounding returns. The formula doesn’t adjust for risks either, so that is something else to be taken into consideration when making investment decisions.

What is a good ROI for a business?

It depends on the situation. There is no one-size-fits-all definition that would apply to all instances. However, it can be agreed that the higher the ROI, the better.

After understanding the basics of Return on Investment, you might be interested in diving deeper into the concept. Check out our article on Return on Investment Explained: Importance & Use to learn about its significance and practical applications in business. For those looking to enhance their customer interactions, exploring the features of a Customer Service Center can be incredibly beneficial. Discover what makes an efficient support center and improve your customer service strategies today.

Understand call centers: function, benefits, and ROI impact

Streamline customer support with LiveAgent's call center. Easy setup, advanced features, free trial & budget-friendly plans. Try now!"

Understand call centers: function, benefits, and ROI impact

Discover the ins and outs of call centers, their benefits, common challenges, best practices, and future trends that can shape the industry.

Български

Български  Čeština

Čeština  Dansk

Dansk  Deutsch

Deutsch  Eesti

Eesti  Español

Español  Français

Français  Ελληνικα

Ελληνικα  Hrvatski

Hrvatski  Italiano

Italiano  Latviešu

Latviešu  Lietuviškai

Lietuviškai  Magyar

Magyar  Nederlands

Nederlands  Norsk bokmål

Norsk bokmål  Polski

Polski  Română

Română  Русский

Русский  Slovenčina

Slovenčina  Slovenščina

Slovenščina  简体中文

简体中文  Tagalog

Tagalog  Tiếng Việt

Tiếng Việt  العربية

العربية  Português

Português