How do you run a healthy SaaS company? It starts with understanding the customers that are leaving—your user churn.

Understanding user churn is essential to the long-term success of SaaS companies, and high churn could be a key factor in a SaaS company’s failure. Even if other aspects of your company are on point, this nagging issue of unconquered churn will destroy your customer base, eat through your revenue, and sink your business if left unchecked.

It isn’t enough to just think about your churn and acknowledge it’s there. You have to calculate it correctly, recognize its detrimental effects, and double-down on the strategies that correlate with lower churn.

To run a truly healthy company, you need to get your churn in check. Below are three critical errors that are stopping you from conquering your churn.

You’re calculating churn wrong

The first step to conquering your churn is knowing your churn. Your churned customers are the customers that discontinue your product or service. Churn rate is the rate at which customers discontinue over time.

For example, if you have 100 customers on the first day of January and you have 97 customers on the first day of February, 3 users have churned in that month. You have a monthly churn rate of 3% for January because 3 out of your initial 100 customers discontinued.

Churn rate is an ideal measurement for your company to master because it isn’t a vanity metric—it actually shows you the effects of your actions and helps you make predictions for the future of your business. A firm grasp on your churn helps you understand other aspects of your business such as:

- Customer retention rate (the inverse of churn rate—the rate at which customers stay on with your product or service)

- Customer Lifetime Value (LTV—the total revenue a customer will generate over their lifetime with the company)

- Which types of customers are more likely to retain/more likely to churn

- Identify adverse changes that may correlate with churn

But you won’t be able to do any of these if you’re making critical—but common—miscalculations.

What you’re doing wrong

The calculation of churn is contested and can be difficult to understand.This is because there are many ways to calculate churn and many different factors that have to be solidified before you can start making consistent and accurate churn calculations such as:

- How you count your customers. This depends on whether you count total customers for the month as the number of active customers on the first day of the month, or whether you include users that sign up during the month in that month’s total customer count.

- When you consider a customer “churned.” This may be when a customer’s last payment was made, or when they actually stop using your service.

- How your sample size of churned customers scales as your business grows. This is because smaller sample sizes may skew results and may not accurately model churn for larger sample sizes.

- How you segment your customers. This depends on whether you look at churn for all of your customers or whether you look at cohorts of customers on different types of plans, who signed up at different times, et cetera.

- The time frame you’re measuring. This may be one week, one month, quarterly, yearly.

- Seasonality. This depends on whether your product is more popular, helpful, or relevant at certain times of the year than at others.

So if you’re segmenting customers by users on a low-tier plan and users on enterprise plans, you might find that the former has a 10% churn rate while the latter has a 1% churn rate. Perhaps you were measuring monthly churn but switched to measuring quarterly churn and found your predictions to be very wrong. You may even sell a SaaS product that does better during the school year and see your churn jump significantly in the summer months.

On top of these confounding factors, there are so many different ways that SaaS companies go about calculating churn—43 last time we counted. They rely on different permutations of the factors above.

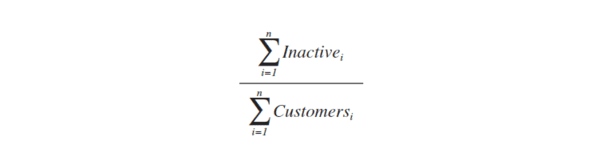

For example, one method tries to predict how many customers will churn on any given day by taking the summation of the customers that will have become inactive one month from now and dividing by the summation of the customers that your company will have one month from now:

This is problematic because you need to know two months’ worth of data to make calculations, and all of your calculations will be about the previous month’s churn. You want your metrics to be as current as possible. It also requires a lot of work and leaves a lot of room for error when calculating a simple metric.

In more idiomatic terms, there are many possible ways to skin a cat—and many ways to get inaccurate or confusing data.

Do it right to conquer your churn

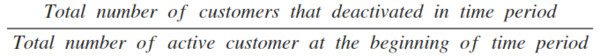

The best way to calculate your churn is to keep it simple:

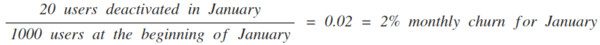

Divide the number of churned customers by the number of customers at the beginning of that time period. If you define your time period as one month, that means dividing the number of customers that churn in the entire month of January by the total number of customers you had on the first day of January. This is how you’ll calculate your monthly churn rate for January.

Using this straightforward formula will make your calculations easy for everyone on your team to understand and compare against other churn rates you’ve calculated (because you know you’re doing them all the same way). You’ll avoid analysis paralysis, because you don’t have to worry about waiting for another month of data or consider any special circumstances.

It will also provide a good foundation for your other calculations. If you want to go further, you can then:

- perform a cohort analysis on your customers by plan

- calculate churn for different seasons

- calculate churn for different time frames

You can always use this formula for more specific segmentations to capture different types of data. But make it easy for yourself, and help make all of your calculations cohesive and straightforward.

You think it’s possible to have a “good churn rate”

So you’re calculating your churn, you’re keeping it simple—now what churn rate do you aim for?

The Pacific Crest Survey, conducted by SaaS-entrepreneur-turned-VC David Skok and Matrix Partners, revealed that the median user churn in SaaS industry is 8% annually. This comes out to around 0.67% monthly.

So is this the magic number? What exactly is a “good churn rate” for your SaaS company?

What you’re doing wrong

There is no such thing as a “good churn rate.” Any degree of churn leaves your company in a precarious situation: customer acquisition gets more expensive over time and as you lose more and more of the market to churn, you start losing revenue.

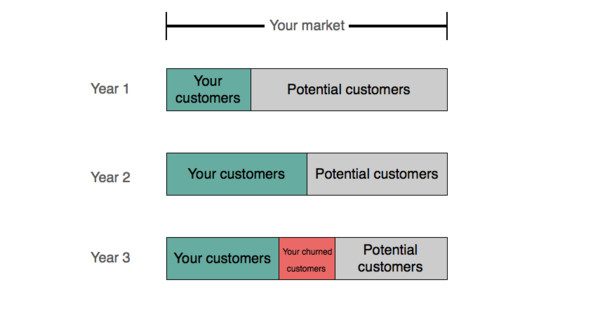

It gets harder to gain new customers as customers churn, because the portion of the market that you haven’t yet sold to shrinks.

For example, in Year 1 you’ve sold to 30% of your market and still have the potential to reach 70% of the market. In Year 2, you’ve sold to 50% of your market and still can market and sell to the other 50% of the market. But by Year 3, though you’ve sold to another 10% of your market, 33% of your total customers have churned.

Now you need to replace those churned customers before you can see gains from new customers—but you have a much smaller pool of potential customers to whom you can market and sell.

Even with a 0.67% monthly churn, which is the median monthly churn for SaaS companies according to the Pacific Crest Survey, your company will lose 8 of its 100 customers over the course of a year. That means that in order to grow, you don’t need 1 new customers, you need 9.

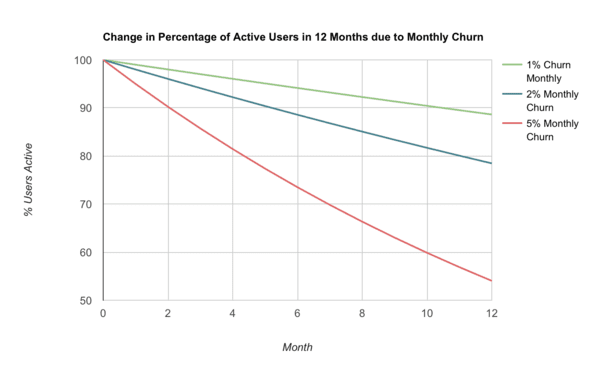

The effects of churn also compound over time. Though a 2% monthly churn rate might not sound detrimental, that means over 20% of your customers have churned by the end of the year. At 5% monthly churn, you’ve lost 46%—nearly half of your customers—by the end of the year.

The difference between 1% monthly churn and 5% monthly churn might not look so bad after 1 month, but when you’re looking a year later at the difference between 11% of customers lost and 46% of customers lost, respectively, the compounding effects of churn over time become clear.

The revenue metrics make it clear too. If you charge customers $70/month and have 100 customers at the beginning of the year, your MRR is $7,000. But with 1% churn, after 12 months your MRR drops to $6,160. With 5% churn, your MRR after 12 months is $3,780.

Any degree of churn will eat away at your business over time. If you want to set yourself up for long-term success, you need to stop thinking that an “acceptable churn rate” exists.

Do it right to conquer your churn

Your SaaS company should be aiming for net negative MRR churn. This happens when the MRR gained from new accounts and upgraded existing accounts is greater than the MRR lost from churned accounts.

To reduce your churn, your company should aim to:

- Create a better monetization strategy: This will help you on every front. A value-based pricing strategy will help you acquire more customers because customers will be more inclined to pay a price that corresponds with the value they want. It will help you retain and upgrade customers to larger plans, because clearly defined and communicated pricing tiers reduce the friction of upgrades. It will also prevent user churn, because customers will be paying for the corresponding core value of your product that is exactly right for their company.

- Focus on retaining customers and upgrading existing customers rather than acquiring new customers: We’ve pointed out that as your market shrinks, new user acquisition becomes more challenging. But there’s an even more compelling reason to focus on upgrades—according to the book Marketing Metrics, you have a 5-20% likelihood of a successful sale with a new customer and a 60-70% likelihood of a successful sale with an existing customer.

- Target churn at different stages of your customers’ lifecycle: Short-term churn, mid-term churn, and long-term churn all look different in terms of user behavior and can be solved by targeting different areas of your marketing, product development, customer support, and monetization. Understanding the different stages of user churn and the strategies for each stage will give you a framework to take action.

Once you get in the mindset that no amount of churn is acceptable, you can strive towards negative churn and see a positive net MRR each month

Your customers’ ARPU is low

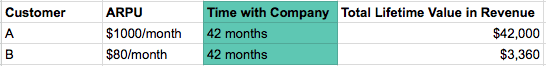

Customers with high Average Revenue Per User (ARPU) are valuable to your company because they have the potential for high Lifetime Value. One reason for this is simply that customers with higher ARPUs contribute more to revenue growth than customers with lower ARPUs over the same amount of time:

Customers with high ARPU can also have a higher Lifetime Value by extending their lifetime with the company. Customers that pay more per month have actually been shown to stick around longer and have a lower churn rate.

What you’re doing wrong

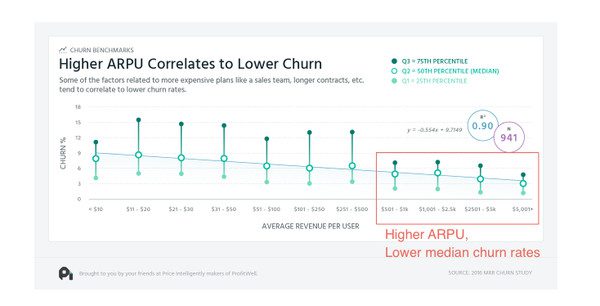

Maybe you think that lower prices will entice customers to join and to stay around longer. But Price Intelligently’s study of 941 SaaS companies found that higher ARPU correlated with lower churn. Customers with four-figure ARPU showed almost 50% lower churn than customers with single- and double-digit ARPU.

This graph by ProfitWell shows that the median churn rate for customers in all ARPU brackets greater than and including $501-1k were lower than the median rates for customers in lower ARPU brackets.

This relationship indicates correlation, not causation. These customers don’t have lower churn necessarily because they have higher ARPU. However, the factors that link them are important for understanding how to lower your churn and improve your company’s revenue. Customers with higher ARPU are likelier to have lower churn for several reasons:

- These customers are likely on enterprise plans, which may have annual contracts rather than monthly contracts. It may seem obvious but it’s worth iterating: annual renewal (as opposed to monthly renewal) reduces the opportunity for cancellation.

- Companies that sell to high ARPU customers are likelier to have sales teams, who can help to re-sell existing customers on a renewed or upgraded plan and lower churn.

- Companies that have the capacity to offer high ARPU plan have likely thought about their monetization strategy and how they can best monetize enterprise-level customers, who will require the most value that the company offers and have the greatest opportunities for revenue.

Don’t get caught up in thinking that customers will be drawn in by lower-priced plans because they’re “deals.” These kinds of customers may be less serious about your product, and more likely to churn. Then you’ve lost a paying user and you’ve wasted time and money marketing to a non-ideal customer.

Do it right to conquer your churn

At the level of highest concept, treating all of your customers like they are high-ARPU customers can improve retention and up-sells. SaaS companies white-glove their enterprise customers because they know they have huge LTV potential. But you should always be putting the customer first by communicating and developing relationships with them.

This translates into both a change in mindset and tangible improvements in customer relationships such as:

- Giving more surveys to your customers to get feedback, and taking action on their answers

- Providing 24/7 customer service with the help of AI and bots to augment service and reroute to human customer service team members

- Having more customers talk to sales representatives to figure out what plan is really best for their companies

You can also utilize this information to acquire and retain more high-ARPU customers:

- Monetize new and existing customers better by creating a pricing plan that scales alongside a value-based metric. You’ll capture more value without leaving any money on the table. You’ll also create an opportunity for customers’ plans to grow as their own companies grow. This means customers that originally start off as low-ARPU customers may become high-ARPU customers over time.

- Consider adding more annual contracts into your pricing plan. Annual contracts do add to your CAC because they cause your customer to incur opportunity costs when the cannot cancel. But they reduce the opportunity for churn and can increase LTV, so it could be a worthwhile investment for your company.

A higher percentage of annual contracts per company correlates with a lower gross churn rate. Though most companies think of long-term contracts as a way to increase cash flow, they have bigger implications. Employing annual contracts is a huge opportunity to tangibly reduce your churn.

Establishing long-term contracts with customers provides businesses with a sustainable supply of cash. This steady source of income enables companies to plan ahead, secure relationships and allocate resources for further development.

Conquer your churn before it conquers your company

Churn is not straightforward to calculate or to reduce—yes, here there be dragons. But losing customers hurts your revenue, your brand reputation, and your potential for future success. It’s worth taking the time to get a grasp on your churn for the sake of your business’s future.

Reducing churn is a company-wide effort. Using accessible and cohesive calculations, eschewing the idea of “good churn,” and understanding the mentalities and strategies that lead to lower churn will help unite your team in these efforts. Happier customers, better branding, and a stronger bottom line will show you that your hard work is paying off.

Share this article

Every Call Center Agent Should Master These Voices

Implementing strategies such as warm and enthusiastic, cold and authoritative, and warm and professional tones of voice in customer service can help match the customer's mood and behavior, leading to effective communication and exceptional customer service. Understanding and utilizing these tones can greatly improve customer interactions.

3 HUGE Mistakes Marketers Make Using ChatGPT

Mistakes when using Chat GPT for marketing include not providing examples, being too vague, and not editing the generated copy. Specific details and style improvements can greatly enhance the quality of the results.

The AI Automation Niche is a GOLDMINE Right Now

AI automation agencies are the next big thing in online business, offering the opportunity to leverage AI technologies to improve productivity and increase profits for businesses. This business model is accessible, scalable, and cost-effective, making it a low-risk, high-reward opportunity for entrepreneurs. With the potential to charge higher fees as experience and case studies grow, AI automation agencies present a compelling opportunity for the future.

How to turn your customer service team into your best sales channel

Implement proactive customer support, prioritize getting reviews after positive interactions, and create an educational training library for customers. LiveAgent offers various communication channels for businesses and emphasizes the importance of managing customer expectations.

Български

Български  Čeština

Čeština  Dansk

Dansk  Deutsch

Deutsch  Eesti

Eesti  Español

Español  Français

Français  Ελληνικα

Ελληνικα  Hrvatski

Hrvatski  Italiano

Italiano  Latviešu

Latviešu  Lietuviškai

Lietuviškai  Magyar

Magyar  Nederlands

Nederlands  Norsk bokmål

Norsk bokmål  Polski

Polski  Română

Română  Русский

Русский  Slovenčina

Slovenčina  Slovenščina

Slovenščina  简体中文

简体中文  Tagalog

Tagalog  Tiếng Việt

Tiếng Việt  العربية

العربية  Português

Português